Wyndham features an impressive catalog of resorts from a quantity perspective. I find, however, that quality lacks compared to its peers. Though, you can certainly find some gems, including those in the Caesars and Wyndham Grand lineups. Wyndham properties include Super 8, Travelodge, Days Inn, and Ramada, just to name a few. Additional options can be found on their about page.

Usually, the sign on bonus for the Wyndham Rewards Visa fee card ($75 annually), which is serviced by Barclays, is 30,000 points. 15,000 of those points are awarded after making your first purchase. The remaining 15,000 are deposited after spending $2000 within 3 months of opening the account. You’ll also earn 6,000 points annually on your cardmember anniversary. The $75 annual fee is not waived for the first year. There is a free card that rewards users with the base 15,000 points after the first purchase.

Currently, there are offers circulating with a more generous bonus for the fee card. This offer gives an additional 15,000 points after the first purchase, making it, in aggregate, worth 45,000 points. No word on how long this will last. For the final rating, I’ll be using the standard bonus for the fee card.

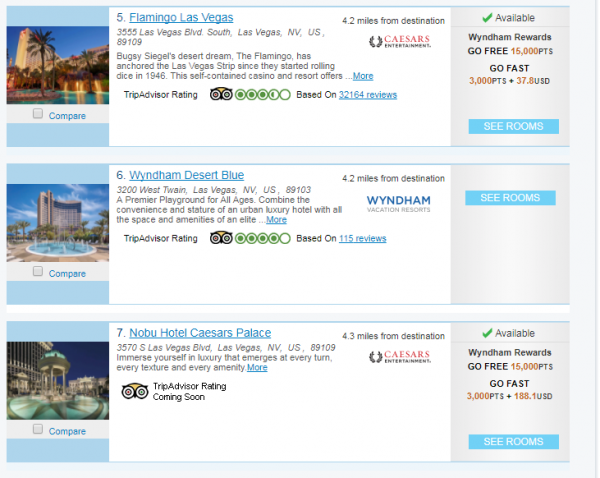

One of the nicest aspects of the rewards program is that free rooms, regardless of property category, come at a fixed cost of 15,000 points. With this parameter, not all points are equal. When looking to take advantage of points in a given destination, it pays to browse all resorts in the area. Take, oh I don’t know, the Las Vegas Strip, for example. On the same day, you can get a room at Flamingo or Nobu for the exact same rate when using rewards points. Flamingo is perfectly adequate, but it’s no Nobu. Wyndham Rewards presents a fun opportunity to stay at resorts that may have otherwise been out of your price range.

Another plus for Vegas fans is the opportunity to tier match with Caesars. I guess I should have mentioned earlier that a partnership has been established between Wyndham and Caesars. The fee card from Wyndham grants automatic Platinum status in Wyndham Rewards. This is can then be matched, simply enough, with Platinum status at Caesars. Perks include free parking at Caesars’ Las Vegas properties and a complimentary two-night stay at the Atlantis Paradise Island resort, among many others.

Bonus points for spending are a little different than most travel cards, in that outside of Wyndham and partner properties, the only bonus, 2x, is rewarded for gas, utility, and grocery purchases. I find it interesting that travel-related expenses are not included. This may be beneficial as a daily card given that, for many families, groceries are a large categorical spend. However, there are several other credit cards that offer more aggressive cash back multipliers for grocery and gas spending. Bonus points are awarded at a rate of 5pts/$1 at Wyndham property stays and 1pt/$1 for everything else.

I can’t comment on the efficiency of the Barclay portal, as I’ve never had a Barclay card before. For me, the value of the card is in the sign on bonus, but if you’re a fan of Wyndham properties, of which there are a lot, or are looking to maintain platinum status at Caesars on the cheap, this has the potential to be a keepable card. This likely would not have even been on my radar had it not been for the fixed 15,000 point redemption for all rooms. It does make lower tier rooms more expensive, point wise, but enhances value for potential luxury stays. I should also note that having spent a lot of time on the Wyndham Hotels site to research this post, I found it one of the most user-friendly experience when looking to book rewards stays. This shouldn’t be a catalyst to sign up for their credit card, but it’s something to note.

What are your thoughts?

Wyndham credit card: fee schedule and promotion details

The information herein should not be considered prescriptive financial advice. Travel Fanboy receives no commission or compensation from any credit card issuer or affiliated companies. The opinions expressed are the author’s alone.

For information on how the churn and burn process can impact your credit score: Churn and Burn Credit Score Guide

Wyndham Wyndham Everywhere

-

Sign-on Bonus

-

Spending Bonus

-

Flexibility

-

Relative Value

Summary

$75 annual fee

30,000 point sign-on bonus

5x points on Wyndham stays

2x points on gas, utility, and grocery purchases

6,000 bonus points annually

No foreign transaction fees

Caesars Platinum tier match

Add comment