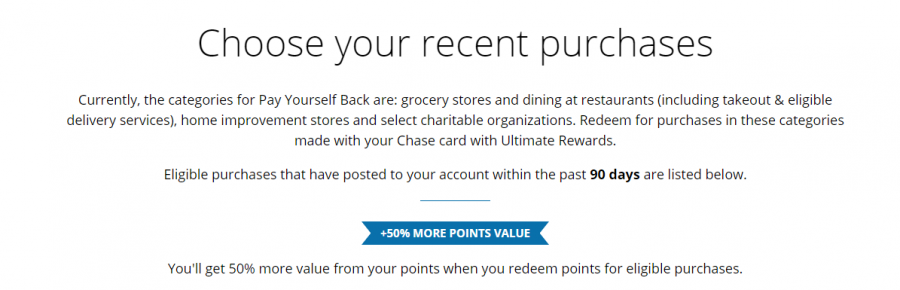

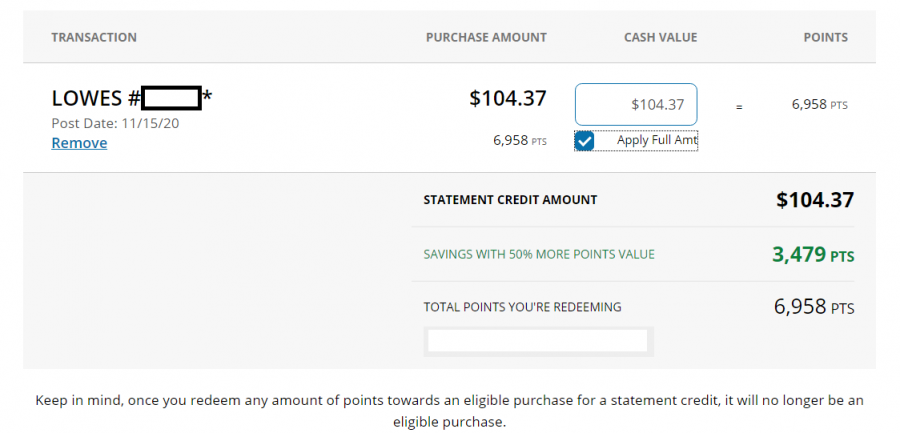

And it’s all thanks to the Chase ‘Pay Yourself Back’ redemption opportunity. Miles to Memories has a good rundown on the promotion, which is open until April 30, 2021. With the CSR, I’m able to redeem my points for statement credits, essentially wiping out recent home improvement purchases at a rate of 1.5 cents per point.

I’m not an advocate or hoarding miles without a plan. With Ultimate Rewards points to burn and no major travel on the horizon, I’m comfortable with this redemption rate. This promotion may not be the catalyst to get this card, but if you have it and are taking on some projects, this is certainly a worthy way to spend those points.

Beyond home improvement stores, other spending eligible for the enhanced ‘Pay Yourself Back’ rate are grocery stores, restaurants, and select charitable organizations. I didn’t take a dive to see which organizations are included. Sapphire Preferred cardholders aren’t left in the DIY dark—CSP card holders can redeem their points in the same categories at a rate of 1.25 cents per point.

Many of us have ideal redemption rates for our points and miles. Its possible and easy to get 2+ cents out of an Ultimate Rewards point. As Miles to Memories mentioned in their post, Hyatt offers a consistent way to do so. But honestly, you should spend them however you want, redemption rate be damned. Want to dress up the home with holiday decor? Erase some Home Depot spending. Need to ease the cost burden of some decent take out? Wipe out a restaurant receipt. Maybe you should just go to your best stocked local grocery store and buy the most expensive bottle of wine on Chase’s dime.

Add comment