Update (06/13/2020): Wyndham has announced that they are not currently accepting status match opportunities from other hotel loyalty programs, which makes the strategy below obsolete. However, status matching between Wyndham and Caesars Rewards is still available.

It takes 15,000 tier credits to reach Caesars Diamond status. The benefits can be quite substantial for frequent Vegas visitors—no resort fees, free parking, and a $100 celebration dinner can really help make a trip more affordable. But is it worth stretching your gambling dollar, succumbing to whims of volatility, all in the pursuit of perks? For low rollers, it’s probably not.

That’s why many turn to an alternative path, the Founders Card. FC is a membership that grants card holders access to a number of discounts and benefits. The most pertinent being complementary Caesars Diamond status. It’s a direct, easy option for those not wanting to put their bankroll at risk. But FC can be pricey. A one year membership costs up to $395. There are benefits beyond Diamond status that can make FC useful, especially if you’re a business owner. But there’s yet an even cheaper option to acquire Diamond status. All it costs is around $100 and a decent credit score.

The key to Diamond for $100 is the direct status match relationship between Wyndham and Caesars. Wyndham and Caesars have, in essence, reciprocal statuses. If you have Diamond status with Wyndham, you can match that to Diamond Status with Caesars, and vice versa. So, it’s possible to reach Caesars Diamond not just directly, but by somehow obtaining Diamond status with Wyndham as well. Currently, Wyndham allows anyone to match a competitor hotel status to into the Wyndham program at the Gold, Platinum, or Diamond level.

There’s no efficient way to reach Wyndham Diamond through Wyndham itself, but you can reach a top tier status with other hotel programs by simply being approved for and holding on to one of their credit cards. If you’re comfortable with this strategy, a hotel credit card with an annual fee of less than $100 can be your ticket to Diamond. Once you receive the status from the other program, you would match it Wyndham then, once processed, match your Wyndham status to Caesars. Processing times vary, but it usually takes less than three weeks for both to go through.

MilesTalk has a handy post and flow chart, documenting the status you would need at competitor programs to match to Wyndham Diamond. Based on his information, here are some credit cards with annual fees less than $100 that should do the trick:

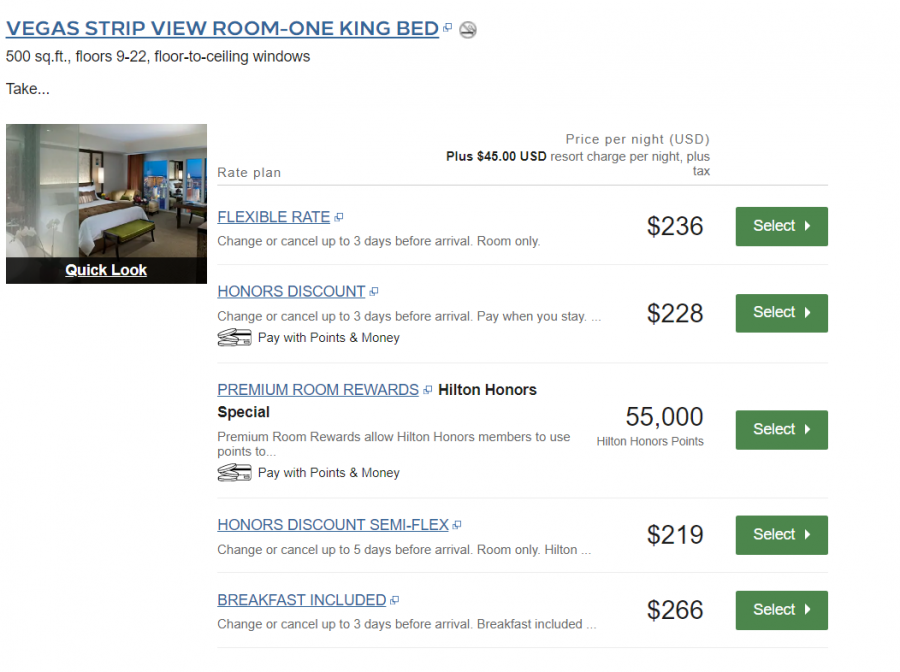

Hilton Honors Surpass (American Express)

Key stats:

- $95 annual fee

- 125k bonus points for $2,000 of spend in three months

- Complimentary Hilton Honors Gold status

- 12x points on Hilton purchases

- 6x points on restaurant, gas station, and supermarket purchases

- 3x points on all other purchases

This is probably my favorite of the bunch. Hilton has a broad portfolio and, in my experience, treats Gold members well, even at some of their more modest properties. Note that the bonus point earnings might seem inflated compared to other cards. It takes more HH points for redemptions than it may other hotel loyalty programs. This is something to be aware of if you’re new to the points and miles and are comparing credit card benefits.

Vegas redemption options include Tropicana, Elara, and the Waldorf Astoria. I’ve seen some great weekday rates at the Waldorf Astoria, which is in a fantastic location in the center of the Strip.

IHG Rewards Club Premier (Chase)

Key stats:

- $89 annual fee

- 80k bonus points for $2,000 of spend in three months

- Complimentary Platinum Elite status

- 25x points on IHG purchases (10x for being a credit card holder, 10x for being IHG Rewards member, 5x for having Platinum Elite status)

- 2x points on restaurant, gas station, and supermarket purchases

- 1x points on all other purchases

This is another solid, inexpensive option. IHG has a large footprint with plenty of modestly priced options. If you’re a Vegas visitor, you can use IHG points to redeem stays at the Venetian or Palazzo, which have some of the largest basic rooms on the Strip.

Radisson Rewards Premier Visa Signature (U.S. Bank)

Key stats:

- $75 annual fee

- 85k bonus points (50k after your first purchase, 35k after $2500 of spend in three months)

- Complimentary Gold status

- 6x points on Radisson purchases

- 3x points on all other purchases

- 40k points for card renewal each year

I’ll admit that I’m rather ignorant to the Radisson Reward program. Superficially, at least, this appears to be a decent card, especially if your travels have you frequenting Radisson family hotels. You can also use your points to book free nights at Treasure Island in Las Vegas, which is one of the better casinos for gamblers on the Strip at the moment. Currently, it takes 44,000 points for a free night at TI. You’d be just shy of two free nights after the initial sign-on bonus is complete.

I have no idea how long this strategy will be valid. For it to continue, the Caesars and Wyndham partnership needs to remain intact. Further, Wyndham has to maintain its competitor match availability. Both could close at a moment’s notice. I would also anticipate more restructuring of Caesars Diamond benefits. Caesars (El Dorado) has already developed multiple Diamond tiers, designed to specifically reward Diamond members who obtained status through gambling. It remains to be seen if additional perks will be rolled into the Diamond Plus and Elite tiers. But for now, the credit card strategy still works. If you’re able and willing, you can still get valuable Caesars Diamond perks for under $100.

To keep Caesars Diamond perpetually, it’s important to know when each program’s status lapses during the year. Your Caesars Diamond status will expire on January 31st, so prior to, make sure to match your status back to Wyndham, that way you can rematch from Wyndham back to Caesars after January 31st. Wyndham’s Diamond status is promotional. It lasts for 90 days unless you complete certain stay requirements. So don’t match back to Wyndham more than 90 days before January 31st.

Recap

- Get top status at a hotel program that matches to Wyndham Diamond

- Match to Wyndham Diamond

- Match to Caesars Diamond

- Match your Caesars Diamond status back to Wyndham after January 1st

- Match Wyndham Diamond status back to Caesars after January 31st

Resources

MilesTalk shows how you can get even more mileage out of these status match opportunities: The Status Match Merry Go Round Explained

I discuss the Founders Card membership program: Is the Founders Card Worth It?

Caesars Rewards: Benefits Overview by Tier

The credit card strategy and your credit report: How a “Churn and Burn” Credit Card Strategy Impacts your Credit Score

The information herein should not be considered prescriptive financial advice. Travel Fanboy receives no commission or compensation from any links on this site. The opinions expressed are the author’s alone. Before applying for a credit card, make sure it fits with your goals and plans. Always do your own research prior to applying for a credit card. The information here was accurate at the time it was written.

Add comment