Citi’s ThankYou Premier credit card isn’t metal, so I’m not sure there is much of a point writing about it. It’s unimpressively light, which limits the air of superiority I can have when handing it over to an apathetic cashier. This, obviously, is the most important factor in choosing a travel credit card, but let’s explore its other features for kicks.

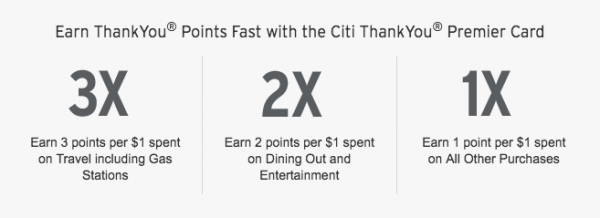

While the card is alloy deprived, it makes up for it with solid earn rates in categories similar to others in its class. Points are awarded at a rate of 3x in travel, 2x in dining and entertainment, and 1x on every other purchase. Where this card differs from many is in the fact that they qualify gas as a relevant travel expense. Other cards in this price range, like the Chase Sapphire Preferred, exclude gas from this category and limit the earn rate of travel transactions to 2x. I’m a big fan of CSP, but this is one area in which Citi ThankYou Premier is much better. As of right now, there is a 60,000 point sign on bonus if $4,000 worth of spending is achieved in the first three months. This is slightly above the standard 50k you’d see with similar cards.

Just like CSP, if you use your points for travel purchases through Citi’s portal, they are worth 1.25 cents per point. Because it counts as a cash booking from the airline’s perspective, this also earns you points through the carrier. I think this is how I’ll be using the card long-term. When booking through the portal, you’re not subjected to blackout dates and award availability issues; it’s points booking simplified.

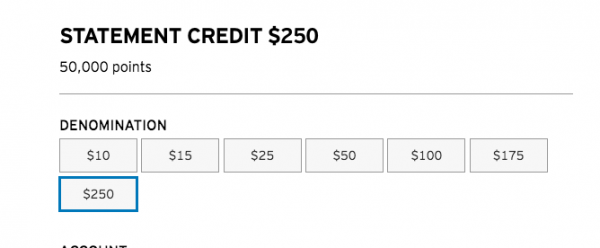

ThankYou points can be transferred to travel partners, but their list currently lacks direct transfers to domestic airlines, spare Jet Blue, and doesn’t offer any hotel options. Bookings with Delta are still possible through indirect partners like Virgin Atlantic and Flying Blue. ThankYou points are great for those looking to travel internationally, as there are some great redemption options to be had, especially with Etihad and Avianca. Points can also be used for gift card purchases and even statement credits, but these, as is usually the case, are a terrible value.

The card features the standard travel card benefits you’d expect, including price protection, car rental insurance (secondary), no foreign transaction fees, and trip delay protection. All this can be yours for an annual fee of $95, which is waived the first year.

I’ve been a Chase and Amex loyalist for a while, but Citi cards are worth considering if you’re looking to expand your flexible point portfolio. Transfer partners may offer limited value for some people, but the ThankYou Premier card is great if you’re looking to primarily do some no-frills bookings through the travel portal.

The information herein should not be considered prescriptive financial advice. Travel Fanboy receives no commission or compensation from any credit card issuer or affiliated companies. The opinions expressed are the author’s alone.

For information on how the churn and burn process can impact your credit score: Churn and Burn Credit Score Guide

Solid Thanks

-

Sign-on Bonus

-

Spending Bonus

-

Flexibility

-

Relative Value

Summary

$95 annual fee (waived first year)

60,000 point sign-on bonus

3x points in travel, 2x in dining and entertainment, 1x all other

no foreign transaction fees

meager plastic

Add comment